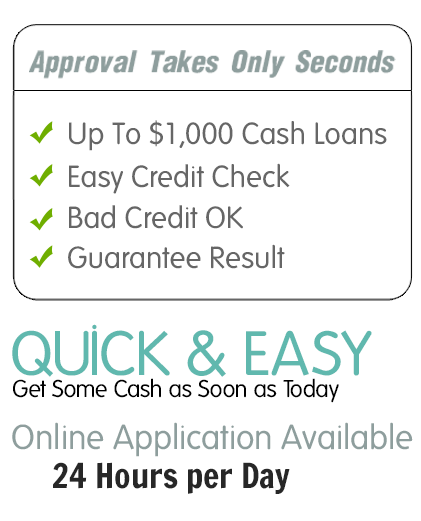

Cash wired directly to your bank account free money loans no interest No Faxing No Credit Check

For example if you took out an average loan of $375 at the average interest rate of 391 percent and you did not make any payments for one year you would owe $1466 After two years you would owe $5733

In five years you would owe $342700 The average new mortgage in the United States in 2012 was $235000

In six years you would owe almost $14 million Remember this started out as just a $375 debt

In 10 years you would owe over $313 million If you took up a collection of $1 from every citizen in the United States you would have just enough to cover your debt

In 18 years you would owe $171 trillion The Unites States national debt in March 2013 was $167 trillion so you would owe more than the whole United States

Now these are extreme cases Rarely does it take someone more than a year to pay off a payday loan These loans are designed to be short-term solutions so the annual percentage rates arent a truly fair comparison

In fact borrowers arent really not paying the loan but they are taking out a new loan every two weeks to a month to pay off the previous loan but it amounts to the same thing

Hopefully these extreme numbers will serve as motivation to pay off any payday loan debt before it gets out of hand You dont want to be forced to go into bankruptcy or worse because your payday loan debt got out of hand

These numbers also should serve as a warning to anyone considering taking out a payday loan Is the payday loan truly necessary Have you explored all your options

If you have taken out a payday loan make sure you are doing all you can to pay it off on time This means exploring how you can bring in extra income or cut back on your expenses so you can save up enough money to pay it off

For extra income you might consider going to a temp agency to work some temporary jobs in your spare time You might even want to get a part-time permanent job so that you can start to pay down your debt or start saving up for emergencies once you have paid off the payday loan so you can avoid another one in the future

If you cant take on another job then look at what you spend your money on and look for things you pay for but dont use such as cell phone minutes or a gym membership If thats not enough look for things that arent really necessary that you can eliminate or go to a cheaper package such as satellite or cable television

Youll be glad you made the necessary sacrifices when you have your payday loan paid off

No comments:

Post a Comment